Exploding awnings, birds flying into windows, collisions with fuel pumps, flooding, theft and damage from potholes were just some of the top caravan insurance claims we settled in 2024.

Tens of thousands of caravanners had fantastic holidays – but not every trip went smoothly. That’s why having a specialist caravan insurance policy is essential. From accidental damage and storm damage to theft, fire and road accidents, all kinds of mishaps can happen when caravanning.

Top caravan insurance claims in 2024

From the every day to the bizarre, we’ve delved into our records to bring you the top caravan insurance claims we settled in 2024. Click to view.

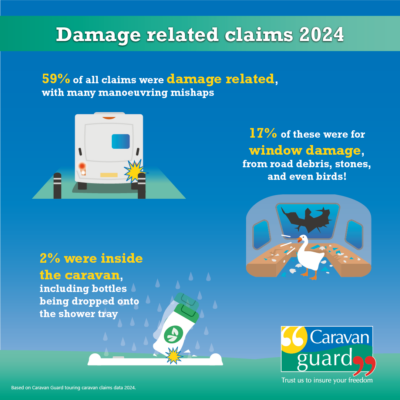

We found that damage-related claims were the most frequent – accounting for 59% of all settled claims last year. All the more reason to make sure you have specialist caravan insurance cover for your pride and joy.

Accidental damage claims

Many caravan insurance claims involved damage caused by manoeuvring mishaps, unexpected hazards, and damage to awnings. Here are some of the most notable incidents:

- Air awnings blew up.

- Stones and road debris cracked panoramic windows while towing or on-site.

- Birds and pheasants collided with caravan windows.

- Manoeuvring accidents led to caravans banging into or scraping against bushes, trees, fences, gateposts, traffic cones, garage doors, walls, road signs and even other caravans in storage yards.

The most expensive damage-related caravan insurance claim involved a caravanner accidentally hitting a bollard while towing, which completely wrote off the caravan, costing £28,000 to replace it! Another significant claim with a payout of £18,000 was after a tree fell through a caravan!

Third party caravan insurance claims

Caravans were damaged in incidents involving lorries, tractors, delivery vans, and other vehicles while towing, in motorway service areas, or on campsites or storage sites. The highest claim involving a third-party was £24,000, after a caravan was rear-ended.

Preventing common accidental damage caravan claims

- Get help when reversing into tight spaces like driveways

- Check your surroundings before pitching up or parking

- Make sure your caravan handbrake is properly engaged – one claim involved a caravan rolling into a concrete bollard! Another caravan’s motor mover failed which saw the tourer crash into an electric point crushing the front panel and breaking the jockey wheel!

- Use a caravan-specific sat nav to avoid narrow roads – one policyholder reversed into a wall after being directed down a country lane, causing £5,000 of damage.

- Be cautious when cooking outdoors near your caravan – an air fryer used in an awning melted the side walls of a caravan, leading to a £3,000 repair bill.

- Tight corners can be tricky—watch our towing tips video with Fliss the Trailer Lady, who advises going “straight and late” when navigating corners and junctions.

Storm and flood damage

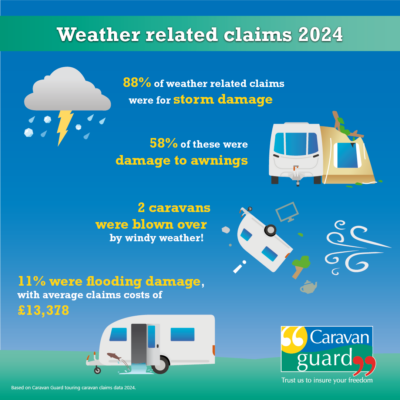

The second most common category of caravan insurance claims in 2024 was weather-related damage, making up 20% of settled claims, with lots of claims reported in April and then again in August after Storm Lilian hit.

Flooding claims were the costliest, with more than £35,700 paid out in one case after a caravan was damaged by floodwater in April last year. A caravan blown over by strong winds in December led to a £27,740 payout.

More than half of weather-related caravan insurance claims were for awning damage, accounting for 58% of storm damage claims and highlighting the importance of making sure your caravan insurance policy includes storm cover for awnings and making sure you’ve insured your awning for the correct value.

Tips to protect your caravan from storm damage

- Avoid towing in stormy conditions.

- Take down awnings if high winds are forecast.

- Use awning storm straps when setting up your caravan awning, especially on seasonal pitches.

Caravan theft

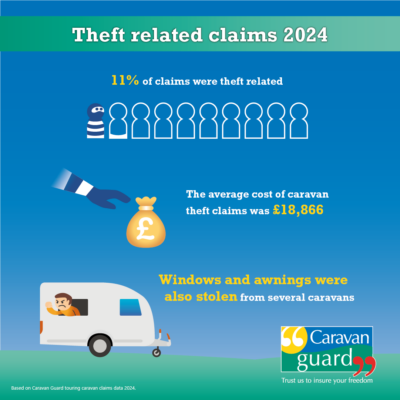

Having your caravan stolen is the worst worry of all, and during 2024, 11% of all our settled caravan insurance claims were theft related.

Many caravan thefts took place from storage sites and farms, reinforcing the need for extra security.

- The average caravan theft claim was £18,866.

- The most expensive caravan theft claims were £39,000, occurring in January and June.

- Thieves also targeted caravan windows, awnings, mattresses, and other parts.

Prevent caravan theft

- Store your caravan in a secure storage location with locked access gates, high perimeter fencing, CCTV and security patrols.

- Install a proactive tracking device to pinpoint the location of a stolen caravan or alert you if it is moved unexpectedly.

Caravan road accidents: Potholes, wheel detachments and blowouts

Ten percent of claims were for incidents on the road, making these the fourth top caravan insurance claim we settled in 2024.

- One-third of road accident claims were caused by potholes with average claims costs of £4,713! One caravanner hit a pothole, which caused a tyre blowout and the caravan overturned, plus numerous caravan panels and axles have been cracked or damaged from hitting potholes.

- 27% of claims involved wheels falling off caravans!

- A quarter of road accident claims were due to caravan detachments from the towing vehicle. The most expensive detachment claim was for £31,000 after a caravan detached and rolled onto its side and landed on a barrier.

- 10% of these claims involved tyre blowouts.

Before every trip, make a PACT for caravan wheel and tyre safety:

- Pressure – Check tyre pressure regularly

- Age – Replace tyres every five years

- Condition – Inspect for cracks or damage

- Torque – Make sure wheel nuts are properly tightened

Watch our hitching-up check video to make sure your caravan is securely connected before hitting the road to prevent a detachment.

Caravan fire claims: Rare but costly

While fires accounted for less than one percent of our settled caravan insurance claims, they resulted in some of the highest payouts. The most expensive caravan insurance claim in 2024 was £48,000, after a caravan was completely destroyed by fire!

Why caravan insurance is important

Whilst caravan insurance might not be a legal requirement unexpected incidents can and do happen. Having the right caravan insurance policy will make sure you’re financially protected against accidents, theft, fire, and weather-related damage.

Find out more about our award-winning caravan insurance cover here.

If you would like to embed this infographic on your own website or blog – please click and copy the below embed code:

Scary, but shows the importance of good insurance.

Well put together covers all the points and pitfalls of what damage can be done and how to try and avoid them happening to you !! I did think the safety check list before you start your journey a good idea

Thanks for the great feedback Bob. Happy caravanning.

Very informative and useful