Motorhome claims come in all different guises and sizes. From reversing mishaps to collisions with fuel pumps, walls and posts, plus flooding, theft and window damage, Caravan Guard helped lots of customers settle their motorhome insurance claims in 2024.

All kinds of mishaps can happen when motorhoming, so it’s important to have a specialist motorhome insurance policy to make sure you’re covered for those common accidents.

Top motorhome insurance claims in 2024

We’ve delved into our records to bring you the top motorhome insurance claims we settled in 2024. Click the image below to view our new infographic and click back on your browser to return to this blog:

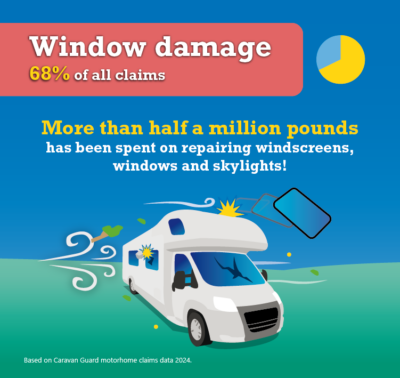

Motorhome window damage

Motorhome window damage tops the list in terms of the number of motorhome insurance claims made. They accounted for a staggering 68% of all settled claims last year.

The cost of these claims was substantial, with payouts for windscreen, window and skylight repairs. Incidents ranged from:

- Stones hitting at windscreens whilst driving

- Unexpected impact damage

- Sunroofs blowing off while driving

- Rooflights damaged by low bridges

Top tip: Make sure your motorhome insurance policy has windscreen cover as standard with no limit on windscreen replacement cost. With Caravan Guard any damaged windscreen, window, skylight made of any material (not just glass) will be treated as a windscreen claim. However, if the bodywork of the motorhome is damaged too, it would be dealt with as one accidental damage claim.

Accidental damage claims

Accidental damage represented more than a quarter of all settled motorhome insurance claims in 2024, often caused by manoeuvring, parking, and unexpected hazards.

Here are some of the top accident damage scenarios:

- 27% of accidental damage claims involved a reversing mishap!

- Deer colliding with two motorhomes

- Parking accidents are common for bumps and scrapes with other vehicles and objects. One policyholder was parking into a bay when they hit another parked vehicle in the next bay, causing almost £22,000 of damage.

- Campsite entrances, bollards and walls were common collision sites. One policyholder caught a campsite post leading to an insurance claim costing over £19,000.

- Trees and overhanging branches were hazards for many motorhomers – in one instance, a tree fell onto a motorhome. The payout was over £10,000.

- Some policyholders had handbrake trouble. One motorhome rolled into a parked vehicle, causing over £6000 of damage!

- Unusual incidents included putting Ad Blue in a diesel tank (£13K claim).

The most expensive accidental damage motorhome insurance claim was for £26K when a motorhomer reversed into a garage! Another significant claim with a payout of almost £17,000 occurred after a motorhome collided with an overhanging tree, causing substantial roof damage!

Third party motorhome insurance claims

Narrow lanes and other large vehicles were the cause of many third party accidental damage claims, with motorhomes encountering scrapes with lorries and numerous parked vehicles.

Incidents in motorway service areas, petrol stations, car parks and storage sites were common. The highest claim involving a third party was £24,000, after a motorhome was rear-ended.

Preventing common accidental damage motorhome claims

- Get help when reversing into tight spaces like driveways and parking bays

- Use a motorhome reversing camera to spot potential hazards

- Always check your surroundings before parking up

- Be aware of the width and height of your motorhome and the rear swing of your motorhome when parking, particularly in car parks

- Make sure your motorhome handbrake is properly engaged

- Use a motorhome-specific sat nav to avoid narrow routes

Motorhome theft

While instances of motorhome theft claims were relatively low in 2024 – just three percent of settled motorhome insurance claims – they were financially significant:

- The average motorhome theft claim was £30,853.

- The most expensive motorhome theft claim exceeded £55K and took place in April 2024.

- Thieves also stole awnings and stripped one motorhome of its parts.

Prevent motorhome theft

- Store your motorhome in a secure storage location with locked access gates, high perimeter fencing, CCTV and security patrols.

- If your motorhome is kept at home, use a security post and other visible devices, such as a steering wheel lock and wheel clamp to deter thieves and slow them down.

- Install a proactive tracking device to alert you if your motorhome is moved unexpectedly.

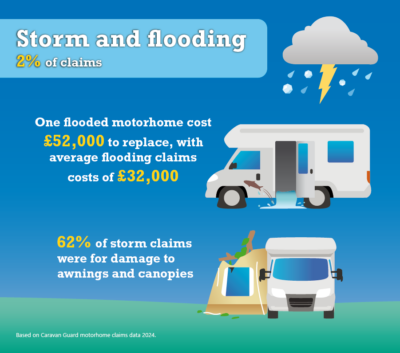

Storm and flood damage

Stormy weather can strike at any time, and storm and flood damage accounted for two percent of settled motorhome insurance claims in 2024, with lots of claims reported in January and April.

Flood claims were the costliest at £32,000 per claim on average. In one example, a £52,000 motorhome was written off by floodwaters in April.

Nearly half of weather-related motorhome insurance claims were for awning or canopy damage, accounting for 62% of storm damage claims and highlighting the importance of making sure your motorhome insurance policy includes storm cover for awnings.

Tips to protect your motorhome from storm damage

- Remove awnings and canopies before high winds hit

- Avoid driving in stormy conditions

- If possible park away from trees during severe weather

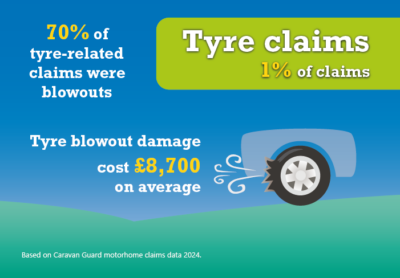

Tyre-related claims

Just one percent of claims were tyre-related.

- 70% of tyre-related claims were blowouts

- The average claim cost as a result of a tyre blowout was just short of £9,000, with one causing a motorhome to go into a ditch after a blowout on a dual carriageway

- The most expensive tyre damage claim was £26,470 from a delaminated tyre. Tyre delamination occurs when layers of a tyre start to separate which affects handling and increases chances of a blowout.

Motorhome tyre maintenance tips

Inspect the condition of tyres, looking for bulges or cracks, and check tyre pressures before every trip. If you can, use a tyre pressure monitoring system to keep tabs on the pressure and temperature of your motorhome’s tyres whilst you’re on the move.

Motorhome fire claims: Rare but devastating

Fire claims were rare – less than 1% of settled motorhome insurance claims – but resulted in some of the highest payouts. The most expensive motorhome insurance claim in 2024 was £60,032, after a motorhome was completely destroyed by a fire!

Why motorhome insurance is important

Unexpected incidents can and do happen, so having a specialist motorhome insurance policy will make sure you’re financially protected against accidental damage, theft, weather-related damage, window damage and incidents on the road.

Make sure your motorhome insurance policy includes cover for accidental damage, awnings, storm damage, theft, and road accidents. Find out more about our multi award winning motorhome insurance cover here.

*Claim figures are based on Caravan Guard’s 2024 insurance claim data. Our motorhome insurance benefits are subject to terms, conditions, cover level and underwriting criteria and are correct at the time of original publication (April 2025).

If you would like to embed this infographic on your own website or blog – please click and copy the below embed code:

very helpfull and reminds you of the obvious that you tend to forget,very good

Interesting information, definitely some things to note. Thank you

Great article – More like this please – – – – Help keep us all on our AWARENESS toes – –

Thank you for the opportunity to comment – – –

Interesting and informative.

Very interesting. Some of the claims made proved to be expensive. If I doubt when reversing? Get out. Check all round especially above and underneath the motorhome. Use all your reversing aids. Take your time. Tyres very good advice about checking prior to everytrip. Not just the easily visible part of the tyre but also the inner wall. Check the spare tyre regularly as well. Liked the advice about checking skylights etc. The number I’ve seen driving off with them open. Ensuring you have the right cover is essential.

Great article. Really makes you aware of the potential problems and hazards should you not have much experience of dealing with a large vehicle.

Very interesting and full of worthwhile information. I enjoyed reading the article

Thanks David. Happy motorhoming! Liz

Very good